Service Charge and GST Setting

It is common for restaurants to impose a service charge on the food & beverage. And the total bill amount including food & beverage and the service charge are subject to GST, which is Goods and Services Tax. Therefore, it is important to configure service charge and GST in NPOS.

It is common for restaurants to impose a service charge on the food & beverage. And the total bill amount including food & beverage and the service charge are subject to GST, which is Goods and Services Tax. Therefore, it is important to configure service charge and GST in NPOS.

Service Charge Setting

[1] Main screen > Click  > Click multiple times on the top empty space.

> Click multiple times on the top empty space.

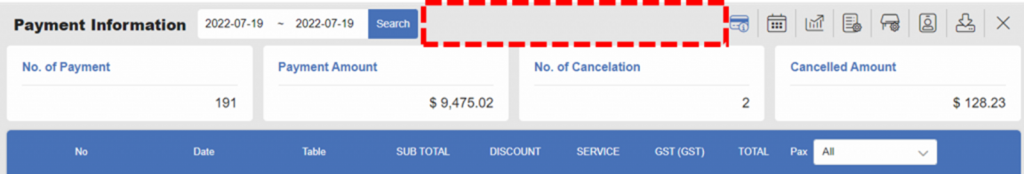

[2] Click Service Charge Setting on the left panel or scroll down to locate Service Charge Setting.

[3] Settings available for Service Charge are listed in the following.

- Service Charge: Enable/disable applying default service charge by clicking the toggle button

- Service Charge (%): Enter numerical value of the service charge % you want to apply

- Service Charge Control (%): Enable selection from various pre-set values

- Exclude Service Charge from TAX : Enable when you want exclude Service Charge from TAX

- Service Charge After Discount: If there is a discount amount, the service fee is charged from the amount after the discount.

- Show in Setting: When enabled, you’ll be able to switch Service Charge on/off easily just by tapping the button on the main screen

- Breakfast – Dinner: Choose the time slots to apply the service charge

- Take-away, Delivery: Choose whether the service charge is applied to take-away and delivery.

- Tables Excluded From Service Charge: Enter the specific table names that the service charge won’t apply to

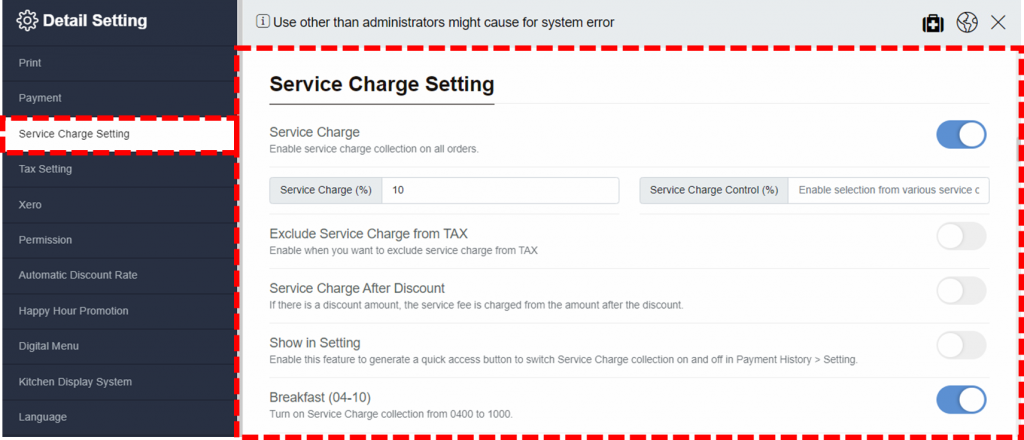

GST Setting

Tax Setting (GST Setting in Singapore) is located below the Service Charge Setting. If your store is a GST registered company, please follow the instructions as below.

- Nation Code: Default code for the stores in Singapore is SG

- Text Box: Key in the name of the tax you’d like to turn on. GST is normally turned on by default for Singapore outlets. The tax will be applied to the orders automatically when the toggle button is checked

- Tax Rate (%): 8% by default

- GST included in the price: Choose whether the tax is included in the price of the items or is calculated and added separately.

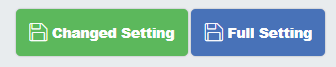

Once you’re done with changing, don’t forget to click Save button!

Related pages

◀️ Go back to NPOS Customization

Last updated on 30 Jan 2023

One Reply to “Service Charge and GST Setting”